October 20, 2025

APPI Says Productive Financing is a Support for Multifinance Industry Growth

KONTAN.CO.ID - JAKARTA. The Indonesian Financial Services Association (APPI) believes that financing to the productive sector is a major driver of growth in the multifinance industry amidst challenging economic conditions.

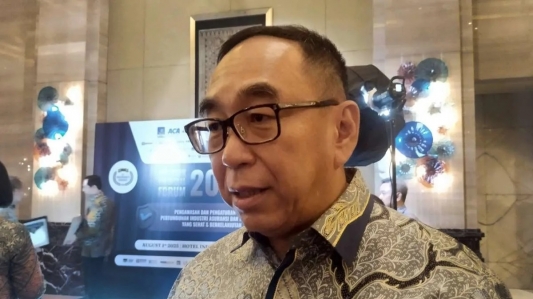

APPI Chairman Suwandi Wiratno stated that this positive trend is inseparable from the strategy of multifinance companies utilizing cash financing products, or refinancing. This scheme is widely used by the public for productive business needs.

"The productive sector has shown good growth. We utilize refinancing, also known as cash financing. That's what keeps us growing, albeit at a slight pace," Suwandi told Kontan.co.id on Friday (10/17).

According to data from the Financial Services Authority (OJK), multifinance financing disbursement to the productive sector reached IDR 246.35 trillion as of August 2025, growing 5.15% year-on-year (YoY).

This productive financing portion is equivalent to 46.24% of total multifinance financing.

Overall, total financing in the multifinance industry reached IDR 505.59 trillion as of August 2025, representing a 1.26% year-on-year increase.

New OJK Regulation a Breath of Fresh Air for Multifinance Companies

Suwandi also responded positively to the issuance of OJK Regulation (POJK) Number 19 of 2025 concerning Ease of Access to Financing for Micro, Small, and Medium Enterprises (MSMEs), which came into effect on November 2, 2025.

According to him, this new regulation will open up more room for the multifinance industry to strengthen financing distribution to the productive sector.

"Of course, the measures implemented in the POJK have been discussed with the association, and we welcome them. This way, we can have more room to maneuver in financing the productive sector," said Suwandi.

Furthermore, he stated that multifinance players can still anticipate the risks of financing MSMEs, as long as they have adequate collateral.

"MSMEs face a high risk if they are given loans without collateral," he concluded.